What is Avail Finance (Unsecured Loan) Application?

Avail Finance (Unsecured Loan) is an app lending platform. Avail Finance provides instant personal loans to all salaried person loans, self-employed and lenders approve unsecured loans based on a borrower’s creditworthiness. Unsecured loans are riskier than secured loans for lenders, so they require higher credit scores for approval.

Products Loan Types :

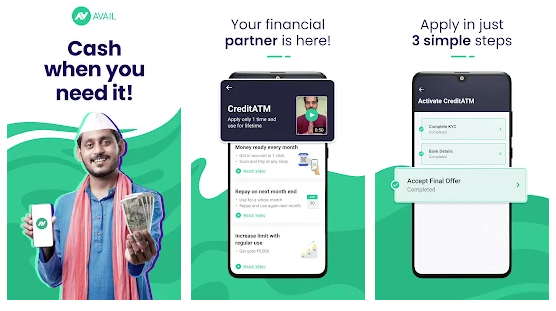

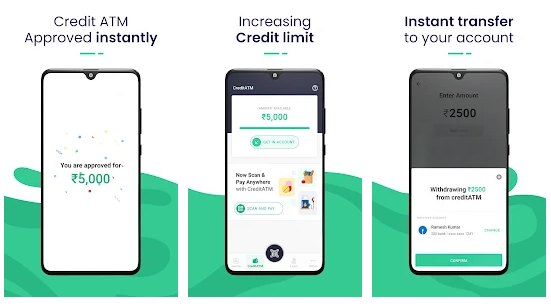

- Credit ATM

- Online credit line app

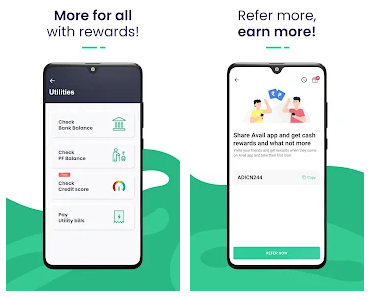

- Bill Payments (electricity bills, water bills, DTH, Cable, LPG booking, FastTag, Mobile phone postpaid bills)

- Short term Loan

- Personal Loan

What is the minimum & maximum loan amount I can borrow?

- For Salary Advance loans you can borrow Rs 1000 to 40,000/-

What are the interest rates of loans?

- Interest Rates from 1.25% to 3% per month.

- Annual Percentage Rate (APR): 42%

- Processing fees : 0 to 1500

- Repayment Period: 270 days.

Example :

- Loan Amount (Principal) : Rs.16,062/-

- Interest Rate: 2.25% monthly Simple Interest

- Tenure: 9 Months

- EMI Amount: Rs.2,146/-

- Total Interest Payable: Rs.2,146 x 9 – Rs.16,062 Principal = Rs.3,252/-

- Processing Fees (incl. GST): Rs.900 (Processing fee @5.6%) +Rs.162 (GST) = Rs.1062/-

- Disbursed Amount: Rs.16,062 – Rs.1,062 = Rs.15,000/-

- Total Amount Payable: Rs.2,146 x 9 months = Rs.19,314/-

- Total Cost of the Loan = Interest Amount + Processing Fees = Rs.3,252 + Rs.1,062 = Rs.4,314/-

- APR = 35.8%

What Documents are required Avail FinanceApp for Loan?

- Pan Card

- Aadhar Card

- Profile pic

- Bank Statement (last 3-6 months)

- Proof of current address (electricity bill, phone bill, etc.)

Why I should choose Avail FinanceApp?

- 100% paperless and digital process on mobile

- 24×7 access to loan/money

- Quick Approval

- No physical verifications or visits

- Low processing Fee, longer tenure, and attractive interest rate

- Fast Disbursal

- Directly disbursed to your bank account

- Pan-India access

- The convenience of payment through various methods

- Repay on time improves credit score and get access to higher amounts

- Repay later option lets you pay part of the loan on the due date & extend the repayment term multiple times.

How do I pay the EMI?

Your EMI payments would be deducted directly from your bank account, subject to NACH approval. Alternatively, you can pay your EMIs using online media such as debit cards, Netbanking, UPI, e-wallets, or cash via Vodafone mPesa.

How long does it take for the disbursal?

After your paperless loan application is approved and you have uploaded the post-approval NACH and KYC documents, Avail Finance disburses the amount to your bank account within 1 working day.

What are the eligibility criteria?

Firstly, citizens should be Indian and aged between 18 and 60 years. We look at a host of information relating to your income, income growth, and stability, spending habits, education credentials, etc. Based on your comprehensive profile, we make a decision on your eligibility for the loan amount applied.

What happens if I default on my loan?

Loan default is a serious offense and is highly non-advisable. In such a case, RBI has mandated all banks and NBFCs to report the default to all 4 Indian credit bureaus (CIBIL, Experion, etc.). As a result, you will not be able to avail of a loan from any other bank or NBFCs in the future. In addition, we may prosecute you for default under Section 138 of the Indian Penal Code if deemed necessary.

What happens if I am unable to pay EMI on time?

Please let us know if you are unable to pay back your loan in due time and we will be happy to extend our best support. Typically, we charge a late payment penalty on any delayed loan repayment. The late payment penalty amount depends on your profile, loan amount, and extent of delays.

What is the process to apply for a loan via Avail Finance (Unsecured Loan)?

Simply, you can download our application on the Google play store, Then Fill in basic details; upload a KYC document, and Income proof Then We will notify you of your loan sanction decision on a near real-time basis upon the completion of your KYC details.

Is Avail Financelegal in India?

Yes, the Avail Finance app is legal, safe to use, and the best loan app in India.

How secure is my data on the Avail Financeapp?

Data security and privacy are a top priority at Avail Finance. We don’t share your data with any third party without your consent and all the transactions are secured via 128-bit SSL encryption

How can I trust Avail Financeapp?

Nowadays, loans have become more accessible to borrowers once they meet the required eligibility criteria. The major concern arises with choosing between banks and NBFCs. In a Financial Stability Report, the RBI confirmed that NBFCs are outperforming banks, increasing customer satisfaction.

Avail Finance acts as a business agent/service provider for the NBFCs licensed by RBI. The NBFCs which use our service are Vivriti Capital Private Limited, Aadhar India Finvest Limited, NDX P2P Private Limited (Liqui loans), and Kudos Finance and Investments Private Limited. RBI has necessitated that trustees would need To know more, you can visit their website.

You can earn more with the help of referring code.

Click here for Avail Finance Loan

Disclaimer: We only give information about applications, Loans, NBFCs, banks, Jobs, and New schemes by reading their website and analyzing all the things. You will get the loan through Avail Finance App.

Aadhar Se Loan Best Loan Website

Aadhar Se Loan Best Loan Website